Axxès

axxes.fr

In 2016, the three regions of Belgium – Flanders, Wallonia and Brussels- have taken an important step in the tax reform. With the introduction of the Kilometer Charge, not the possession of a truck is being taxed, but rather the use of it. This way the cost of infrastructure is billed in a fair way including the environmental effects.

The kilometer charge took effect on April 1st 2016 for all Heavy Goods Vehicles of more than 3.5 tons Gross Vehicle Weight and for vehicles of class N1/BC, irrespective whether the vehicle is empty, fully charged or transporting private goods.

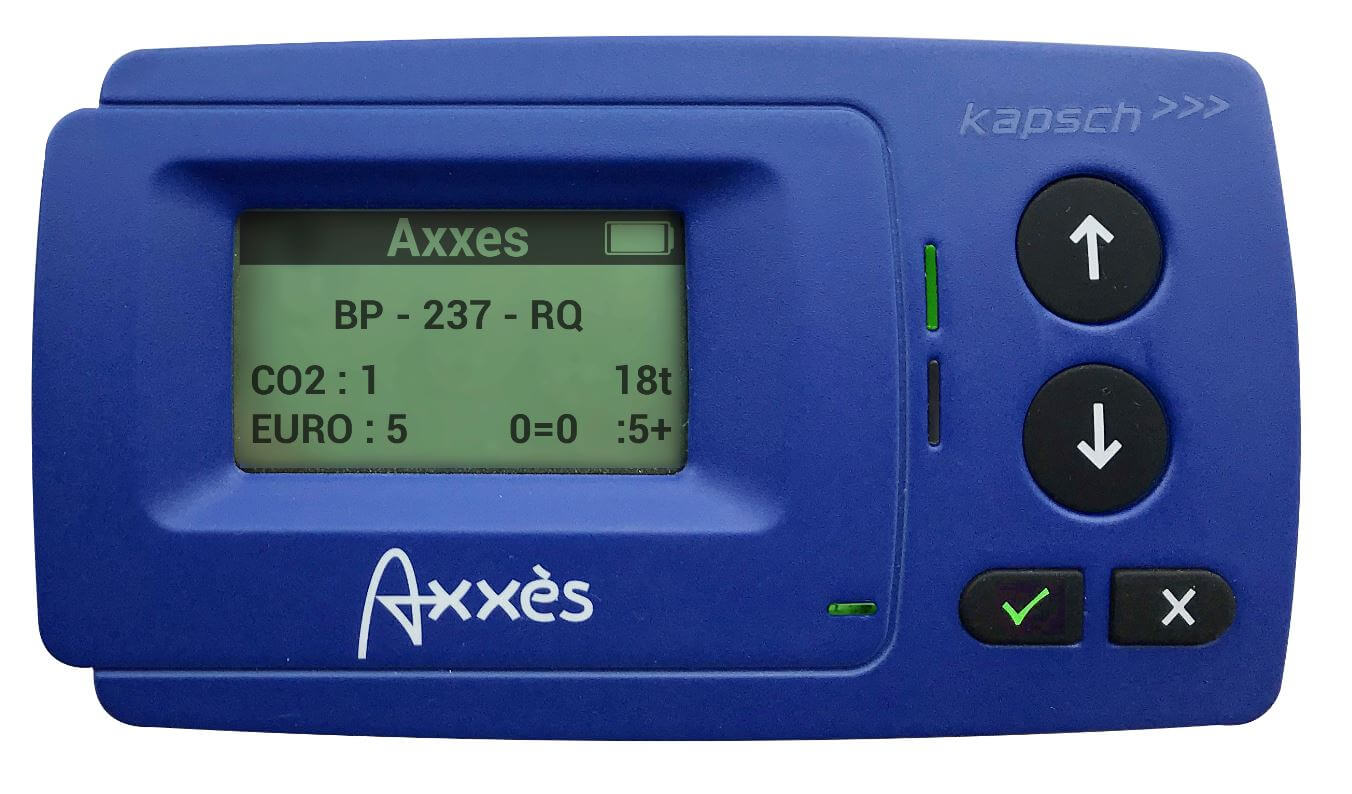

When you have a truck of more than 3,5 tons GVW or an N1/BC, you must have an On Board Unit (OBU) onboard, that is constantly switched on when you take the road in Belgium. An OBU is a small device that registers the number of kilometres you have driven on toll roads. It sends the total to the billing center which delivers you at regular times with a detailed bill.

The OBU can be ordered only at the service providers of the Kilometre Charge, not with Viapass. Contact one of the accredited service providers: Axxès, Satellic, Telepass, TotalEnergies, Toll4Europe and W.A.G. Payment Solutions

Attention: when you come from the UK you must have an OBU to drive the Belgian roads. You can get an OBU at the border through automatic distribution machines. See at the bottom of this page where you can find them.

Stop your vehicle in a safe place and contact your service provider immediately; this is the company that delivered your OBU. They can restart you or help you find another OBU. It is no use calling Viapass, as Viapass is the supervisory authority and does not manage toll boxes.

By driving with a red LED, or without an OBU, you expose yourself to possible fines.

Paying toll afterwards is a procedure that is not possible in the Belgian system.

Axxès

axxes.fr

W.A.G. Payment Solutions

www.eurowag.com

Satellic

www.satellic.be

Telepass

www.telepass.com

TotalEnergies Marketing Services

Totalenergies.com – AS24

Toll4Europe

toll4europe.eu

Either through one of the 120 service points

ATTENTION: You need to order and install an OBU BEFORE you start driving on the Belgian roads.

Still need a last minute OBU on site? Viapass has instructed the national service provider Satellic to install 120 automated distribution points at the border and in Belgium. You can obtain an OBU at these distribution points and you can return it also there when leaving Belgium to get your deposit back. There is no extra charge for this.

The map with the exact locations is to be found at https://www.satellic.be/en-UK/servicepoints.

The use of the OBU is basically free. To get a device at Satellic you have to pay a warranty of 135 €. By returning the device undamaged, you will get a full refund.

At other service providers, the use of the OBU is included in the subscription fee: either ‘à la carte’ for sporadic use, or on a monthly fixed basis for regular use.

The tariffs of the toll roads have been fixed by the governments of the regions, and are to be found in the ‘download’ section of this website. The tariffs have been fixed on the basis of three parameters:

The toll road maps and the tariffs are to be found at the ‘download’ section of this website.

Avoid surprises

For fiscal reasons, it is important that you always obtain an OBU from one of the providers accredited by Viapass (see top of page) or from their official partners. Make sure that the documents and invoices from the Regions containing the kilometer charging information are always addressed directly to you or your company (and not in the name of the partner or its intermediary).

If you have any questions about which documents to receive, please consult our website or contact your accredited provider. If you notice any irregularities, contact us through our contact form on this website.